Lionscove

Enriching lives one relationship at a time

Organizations we support

So what exactly is LIONSCOVE?

We do things differently at LIONSCOVE. Our team is comprised of a group of active real estate investors who seek to add value back to the clients and communities we support. That knowledge helps reduce risk in your investments and drives successful outcomes. Check out the short video that outlines what we do specifically.

What we offer

A STRATEGICALLY SIMPLE real estate investment option for borrowers and investors.

Grow your money

Generate a consistent stream of fixed income (historically 7-9% annualized) by investing in real estate debt.

Borrow money

Get short term capital for your real estate project.

Framework

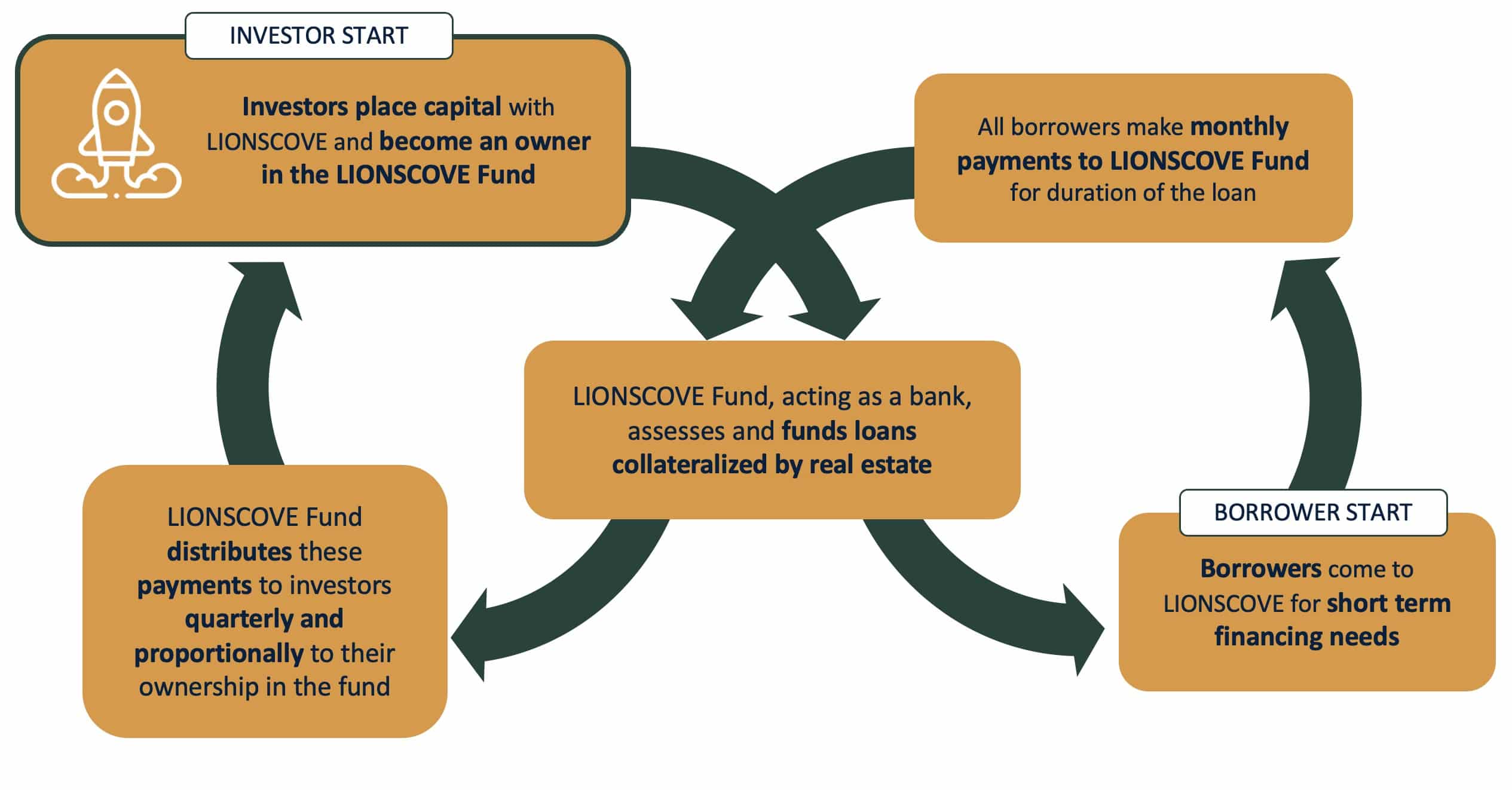

How it Works

LIONSCOVE, operating like a bank, offers short term real estate backed loans (less than 12 months) to borrowers for business purposes based on the equity in the property.

*Source: LIONSCOVE Capital Fund Presentation Deck

LIONSCOVE in Numbers

Know that when you come to us,

you come to Family.

What others say

What you can expect

Why Invest with LIONSCOVE?

-

If you don’t earn money, we don’t earn any fees

-

Higher fixed income return than the market

-

Less risk than the market - safe like the bank

-

Unrivaled transparency - deal level info at your fingertips

Why Borrow from LIONSCOVE

-

Confidence that you will close on time

-

Customized loan terms and scenarios

-

Clear expectations with no surprises

-

Access to exclusive network of connections and resources

Ready to get started?

We offer a variety of financial services depending on what serves you best.

Investors

Provide your contact information and preferences so we can get in touch. Less than 1 minute.

Borrowers

Provide high level details on your project so we can get you a term sheet. Less than 5 minutes.